Odfjell Drilling is focused on maintaining a robust balance sheet and conservative capital allocation strategies. As part of this focus, we will continue to deleverage our company by reducing our net debt to EBITDA ratio over time whilst maintaining solid liquidity to manoeuvre the cycles and capture attractive growth opportunities.

To facilitate our long term strategy, our capitalisation structure includes a mixture of bank facilities and a rated bond which are detailed below.

| Instrument | USD 390m senior secured 1st lien bond (Aberdeen & Atlantic) | USD 197m senior secured term loan facility (Nordkapp) | USD 175m senior secured revolving credit facility (Stavanger RCF tranche) | USD 125m senior secured revolving credit facility (Stavanger term loan tranche) |

|---|---|---|---|---|

| Borrower: | Odfjell Rig III Ltd | Odfjell Rig V Ltd | Odfjell Invest Ltd | Odfjell Invest Ltd |

| Guarantors: | Odfjell Drilling Ltd and various subsidiaries | Odfjell Drilling Ltd and various subsidiaries | Odfjell Drilling Ltd and various subsidiaries | Odfjell Drilling Ltd and various subsidiaries |

| Collateral Rigs: | Deepsea Aberdeen and Deepsea Atlantic | Deepsea Nordkapp | Deepsea Stavanger | Deepsea Stavanger |

| Loan principle: | USD 390m | USD 197m | USD 175m | USD 125m |

| Outstanding per Q3 2024 | USD 350m | USD 154m | USD 40m drawn USD 109m undrawn | USD 107m |

| Maturity: | May 2028 | January 2029 | February 2028 | February 2028 |

| Amortisations: | USD 20m semi-annually | USD 4.25m per quarter until Q4 2026, USD 8.55m thereafter | Quarterly see graph below | Quarterly see graph below |

| Financial Covenants: | i.Equity Ratio ≥ 30% ii.Free Liquidity ≥ USD 50m iii.Current Ratio ≥ 1.0x | i.Equity Ratio ≥ 30% and Equity ≥ USD 600m ii.Leverage Ratio ≤ 5.0x iii.Current Ratio ≥ 1.0x iv.Free Liquidity ≥ USD 50m and Total Liquidity ≥ 5% of IBD | i.Equity Ratio ≥ 30% and Equity ≥ USD 600m ii.Leverage Ratio ≤ 3.0x iii.Current Ratio ≥ 1.0x iv.Free Liquidity ≥ USD 50m and Total Liquidity ≥ 7.5% of IBD | i.Equity Ratio ≥ 30% and Equity ≥ USD 600m ii.Leverage Ratio ≤ 3.0x iii.Current Ratio ≥ 1.0x iv.Free Liquidity ≥ USD 50m and Total Liquidity ≥ 7.5% of IBD |

| Distribution restrictions: | i.Leverage ratio ≤ 3.00 (reducing to 2.00 from December 2025) ii.Total cash (including undrawn RCF) ≥ $150 million (reducing to $100 million after completion of the Company’s final Special Periodic Survey in H1 2025) | i.Leverage Ratio ≤ 3.0x ii.Free cash ≥ $75 million | i.Leverage Ratio ≤ 3.0x ii.Free cash ≥ $75 million | i.Leverage Ratio ≤ 3.0x ii.Free cash ≥ $75 million |

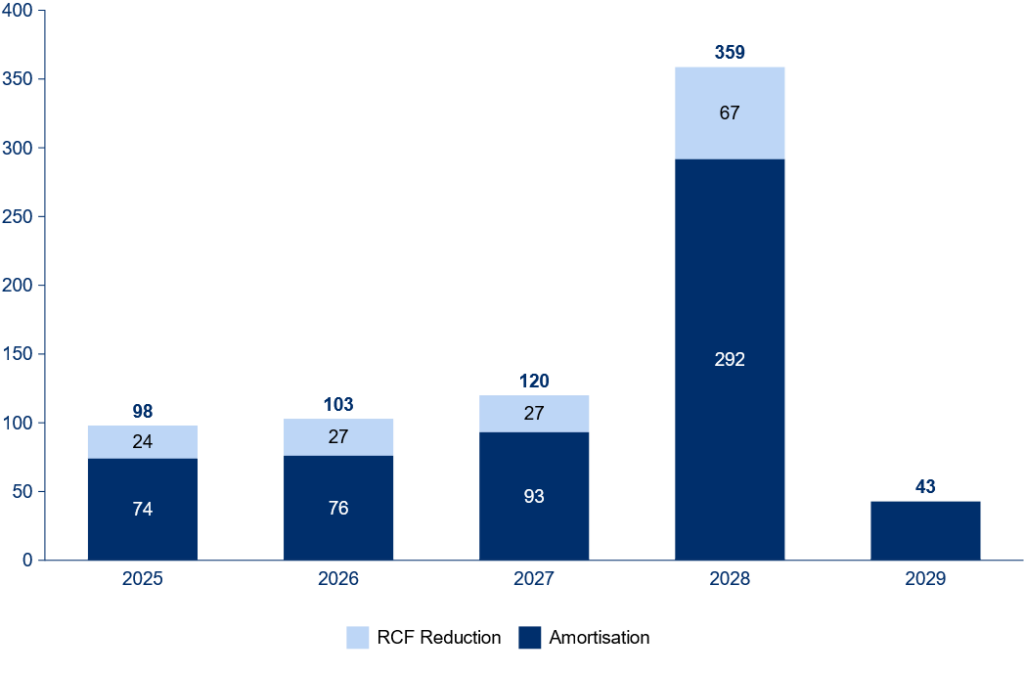

Repayment Profile

Odfjell Drilling has no significant debt maturities until 2028 and has a stable repayment profile, allowing for strong free cash flow generation.

Bond Details:

Debt Level: First lien security related to the Deepsea Aberdeen and Deepsea Atlantic

Issue: USD 390,000,000

Coupon: 9.25%

ISIN: NO0012921172

Maturity Date: May 2028

Currency: USD

Bond Terms:

Credit Rating Agency Reports

Odfjell Drilling Ltd and the Odfjell Rig III Bond is rated by S&P and Moody’s with ratings of B+ / BB (S&P) and B2 / B2 (Moody’s), respectively.

To access the individual reports, please use the following hyperlinks.

Odfjell Rig III Financial Reports

Q2 and First Half year of 2023 Financial Results

Q4 2023 and Full year of 2023 Financial Results